Bachelor of Business Management Honours in Banking and Insurance

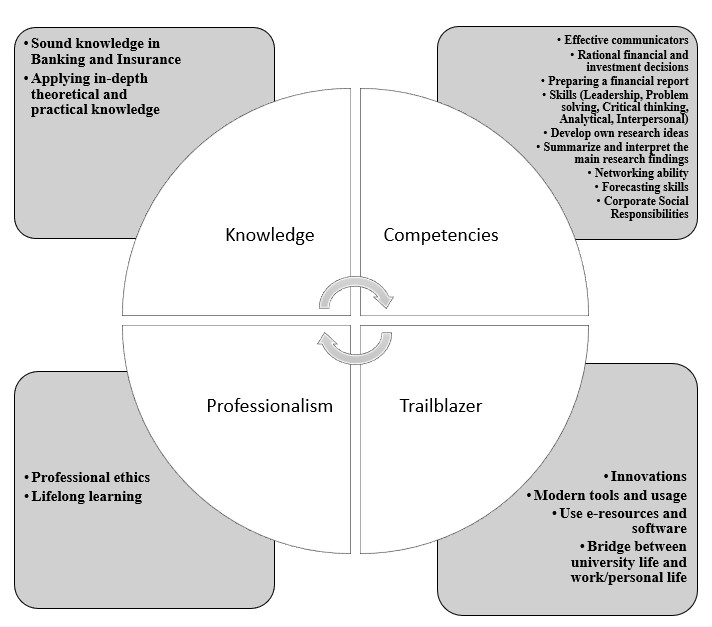

Practical oriented course units in the discipline of banking and insurance have been included in the curriculum, and experts will conduct guest lectures in the field of banking and insurance. Lecture series would be based on the Outcome – Based Education and Student-Centered Learning to attain the generic attributes identified in the Graduate Profile. Bachelor of Business Management Honours in Banking and Insurance seeks to produce the readily employable graduates in Banking and Insurance profession. At the successful completion of the degree program, it is expected that a graduate will be able to shape a career in the field of Banking and Insurance. Graduates can find the relevant information to decision making process and advice to the issues in terms of Banking and Insurance. There are four clusters of generic attributes which the Department of Finance and Accountancy tries to foster through teaching and learning in the Bachelor of Business Management Honours in Banking and Insurance degree. They are:

Figure 01: Graduate profile

Dimensions of the Graduate Profile

- Knowledge

- Having sound knowledge in Banking and Insurance

- Applying in-depth theoretical and practical knowledge in Banking and Insurance

- Competencies

- Communicating effectively

- Making rational financial and investment decisions

- Acquiring the ability to prepare financial reports

- Embedding with leadership, problem-solving, critical thinking, analytical, interpersonal skills

- Acquiring the ability to develop their research ideas

- Becoming capable of summarizing and interpreting the main research findings

- Having networking ability

- Acquainting with forecasting skills in the context of banking and insurance

- Showing commitment to engaging in corporate social responsibilities

- Trailblazer

- Showing ability to identify the innovativeness of modern technologies adopted in the financial institutions

- Being an innovator updating the new trends, various changes, and contemporary issues in the field of Banking and Insurance and bringing the organization to the next level of sustainable success

- Demonstrating the ability to use e-resources and software

- Creating a bridge between university life and work/personal life

- Professionalism

- Having a high regard for professional ethics

- Being committed for lifelong learning

- Synthesizing what they learned from the university and internship and linking them in their work life and personal life

- Acting as effective leaders with self-awareness in the corporate world